Concepts and Principles

- The Guidelines are not legally enforceable, but provide the principles and standards of good practice in multinational enterprises’ business activity and require voluntary compliance. The Guidelines are not intended to introduce differences of treatment against multinational enterprises, but to present the standards of business conduct equally applying to all multinational and domestic and large and small and medium sized enterprises.

General Policies

- Multinational enterprises should contribute to economic, social and environmental progress with a view to achieving sustainable development, respect the human rights of a host country’s people, and encourage local capacity building through close co-operation with the local community.

- They should carry out risk-based due diligence to prevent or identify and resolve any adverse effect of business activities, and encourage their business partners to introduce the principles of responsible business conduct, and they are also encouraged to participate in social discussions with interested parties.

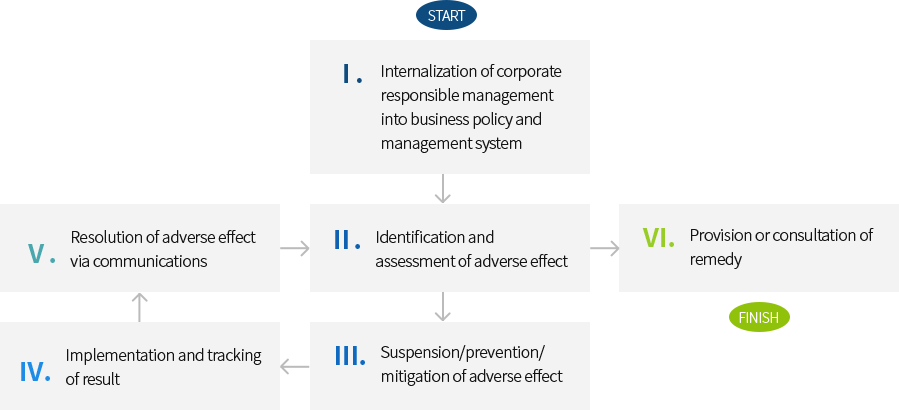

Corporate Due Diligence Process

Disclosure of Information

- Multinational enterprises should ensure that accurate information is timely disclosed with respect to all material matters regarding their business activities, financial conditions and performance, ownership and governance.

Human Rights

- Multinational enterprises should avoid infringing on the human rights of others and causing adverse effects on human rights and address such adverse effects, if any.

They should find a way to prevent or mitigate any adverse effect on human rights through human rights due diligence.

Employment and Industrial Relations

- Multinational enterprises should respect the right of their workers to establish or join trade unions and representative organizations and cooperate with their workers in doing so. In addition, they should guarantee equal treatment for workers and contribute to the effective abolition of child labor or forced labor.

Environment

- Multinational enterprises should, within the framework of laws, regulations and administrative practices in their host countries, conduct their activities in a manner meeting the need to protect the environment, public health and safety and contributing to the wider goal of sustainable development.

Combating Bribery, Bribe Solicitation and Extortion

- Adhering countries should not offer undue bribe to public officials or employees of business partners or illegal contributions to candidates for public office, political parties or other political organizations, making improper demands.

Consumer Protection

- Multinational enterprises should ensure that the quality and creditworthiness of goods and services they provide meet the standards for consumer health and safety, and provide detailed information on content, safe use, environmental implications, management and disposal of goods and services.

Science and Technology

- Multinational enterprises should endeavor to ensure that their activities are compatible with the science and technology policies and plans of their host countries and contribute to the development of local and national innovative capacity, and adopt practices that permit the transfer and rapid diffusion of technologies and know-how, with due regard to the protection of intellectual property rights.

Competition

- Multinational enterprises should carry out their activities in compliance with all applicable competition laws and regulations, and refrain from engaging in any act of market disruption such as fix prices, rigged bids, or output restrictions or quotas.

Tax

- Multinational enterprises should comply with tax laws and regulations of their host countries, and timely provide the relevant authorities with information required by laws for the purpose of accurately assessing tax amount. Corporate boards should adopt tax risk management strategies to ensure that the financial, regulatory and reputational risks associated with taxation are fully identified and evaluated.